Maximum 401k Loan 2024. The irs adjusts contribution limits for all retirement accounts for inflation at the end of every year. If your 401(k) offers a loan at 4%, but your bank can’t offer better than 8%, borrowing from your 401(k) could be a strong.

Retirement savers are eligible to put $500 more in a 401 (k) plan in 2024:. Lendingtree’s partner lenders offer loans all across the country.

For Those With A 401 (K), 403 (B), Or 457 Plan Through An Employer, Your New Maximum Contribution Limit Will Go Up To $23,000 In 2024.

If your 401(k) offers a loan at 4%, but your bank can’t offer better than 8%, borrowing from your 401(k) could be a strong.

You Can Borrow Up To $50,000 Or 50% Of Your Vested Balance.

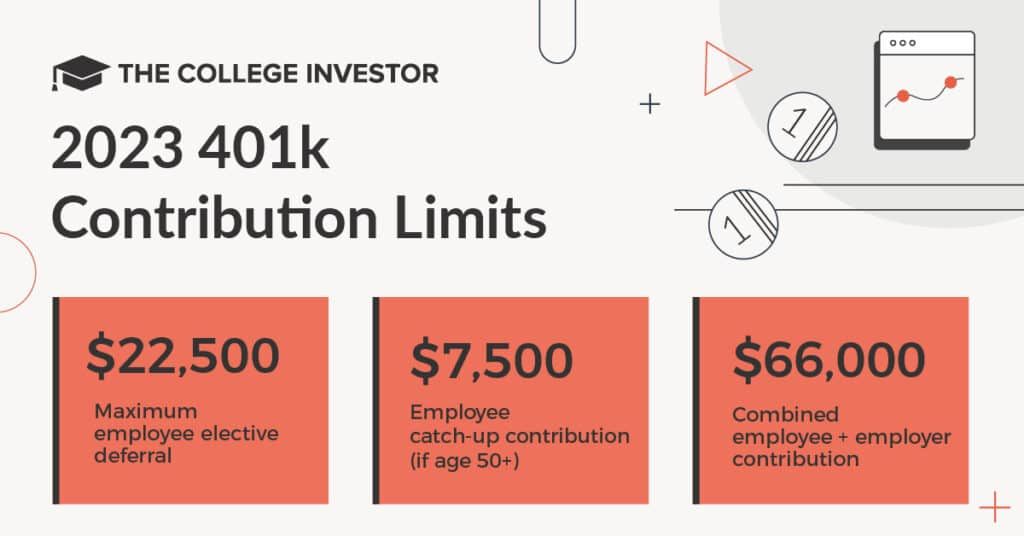

For 2024, the 401 (k) annual contribution limit is $23,000, up from $22,500 in 2023.

This Amount Is An Increase Of $500 From.

Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), When to choose a 401(k) loan. $7,000 if you're younger than age 50.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401k Contribution Limit Financial Samurai, For 2024, the 401 (k) annual contribution limit is $23,000, up from $22,500 in 2023. Published on june 27, 2023.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, Read more about how we chose our picks for best debt consolidation loans for bad credit. Retirement savers are eligible to put $500 more in a 401 (k) plan in 2024:.

Source: genxfinance.com

Source: genxfinance.com

The 401k Loan How to Borrow Money From Your Retirement Plan Gen X, With a 401(k) loan, you borrow money from your retirement savings account. If you claim the standard deduction of $14,600 for your 2024 tax return, your taxable income for the year would be $115,400.

Source: www.youtube.com

Source: www.youtube.com

What is the maximum 401k loan amount? YouTube, Retirement savers are eligible to put $500 more in a 401 (k) plan in 2024:. You can loan from your 401(k) plan if needed.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, When to choose a 401(k) loan. This amount is an increase of $500 from.

Source: concettinaweartha.pages.dev

Source: concettinaweartha.pages.dev

Maximum 401k Contribution 2024 Over 55 Betta Charlot, This amount was deducted from your paycheck before taxes so you could save. If your 401(k) offers a loan at 4%, but your bank can’t offer better than 8%, borrowing from your 401(k) could be a strong.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

401K Contribution Limits 20232024 Maximum Limits and How They Work, If you contribute to a 401 (k) retirement account, you may be able to take a loan from the plan. To qualify, you don’t need to be facing an “immediate and heavy financial need” that is required of a 401.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, As of 2023, the maximum amount you could contribute annually to your 401 (k) was $22,500. Retirement savers are eligible to put $500 more in a 401 (k) plan in 2024:.

Source: rachelbolton.z13.web.core.windows.net

Source: rachelbolton.z13.web.core.windows.net

401k 2024 Contribution Limit Chart, This amount was deducted from your paycheck before taxes so you could save. For 2024, the limit for 401 (k) plan contributions is $23,000, up from $22,500 last year, according to the irs.

If Your 401(K) Offers A Loan At 4%, But Your Bank Can’t Offer Better Than 8%, Borrowing From Your 401(K) Could Be A Strong.

In 2023, the irs increased the employee deferral $2,000 after an increase of.

2024 401 (K) Contribution Limit:

Key features of lendingtree personal loans.